Ms State Treasurer Unclaimed Property

INSTRUCTIONS FOR MISSISSIPPI UNCLAIMED PROPERTY ...

Unclaimed Property Report every third year (2023, 2026, 2029 etc). The Unclaimed. Property Division should receive your report no later than November 1, of ...

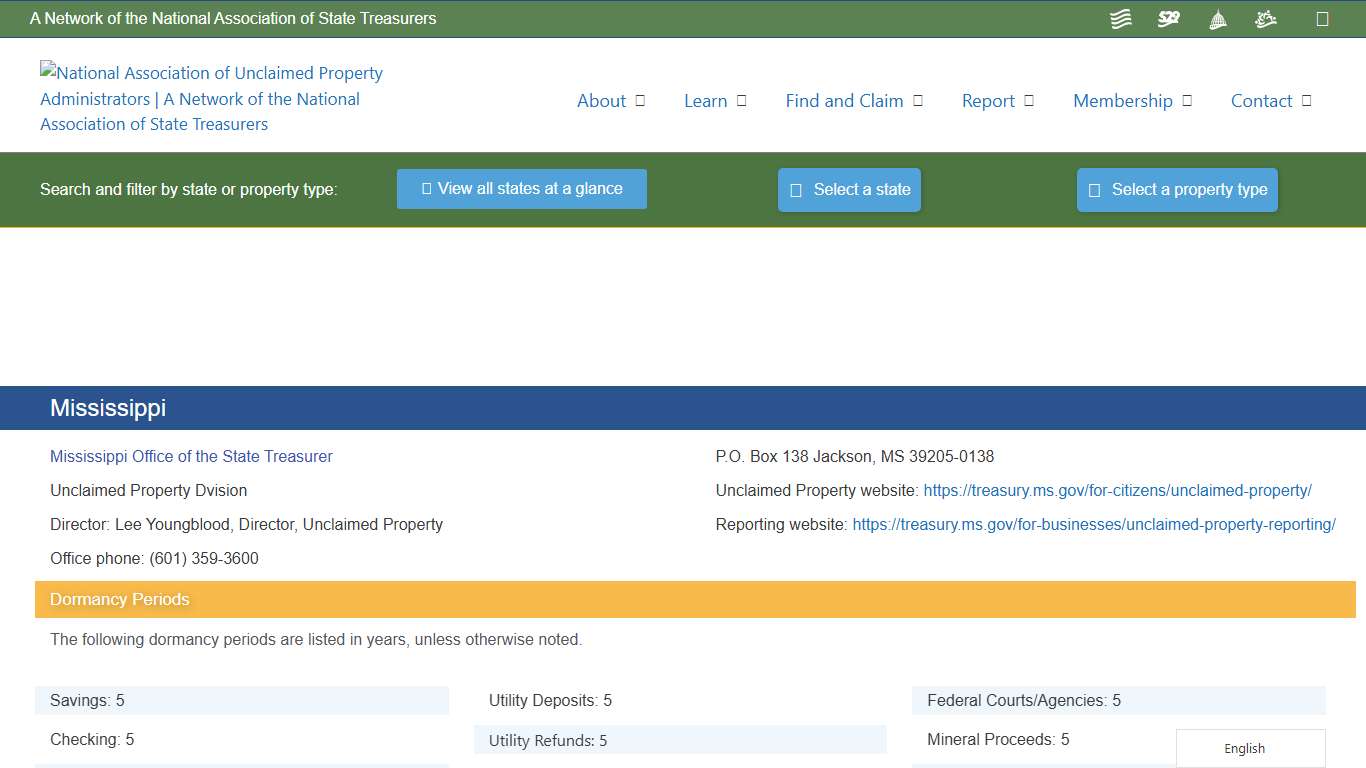

https://treasury.ms.gov/wp-content/uploads/2020/06/Holder-Reporting-Instructions.pdfMississippi – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/mississippi/

Need extra money? Check if you have unclaimed property ...

The Mississippi State Treasury has money and stocks that banks, credit unions ... www.clarionledger.com. All rights reserved.

https://www.clarionledger.com/story/news/2025/11/29/need-extra-money-check-if-you-have-unclaimed-property-in-mississippi/87480999007/MO HB2234 2026 Regular Session LegiScan

MO HB2234 | 2026 | Regular Session Status Spectrum: Partisan Bill (Republican 1) Status: Introduced on January 7 2026 - 25% progression Action: 2026-01-08 - Read Second Time (H) Text: Latest bill text (Introduced) [PDF] Status: Introduced on January 7 2026 - 25% progression Action: 2026-01-08 - Read Second Time (H) Text: Latest bill text (Introduced) [PDF] Summary Requires counties to report and transfer unclaimed surplus proceeds from real pr...

https://legiscan.com/MO/bill/HB2234/2026

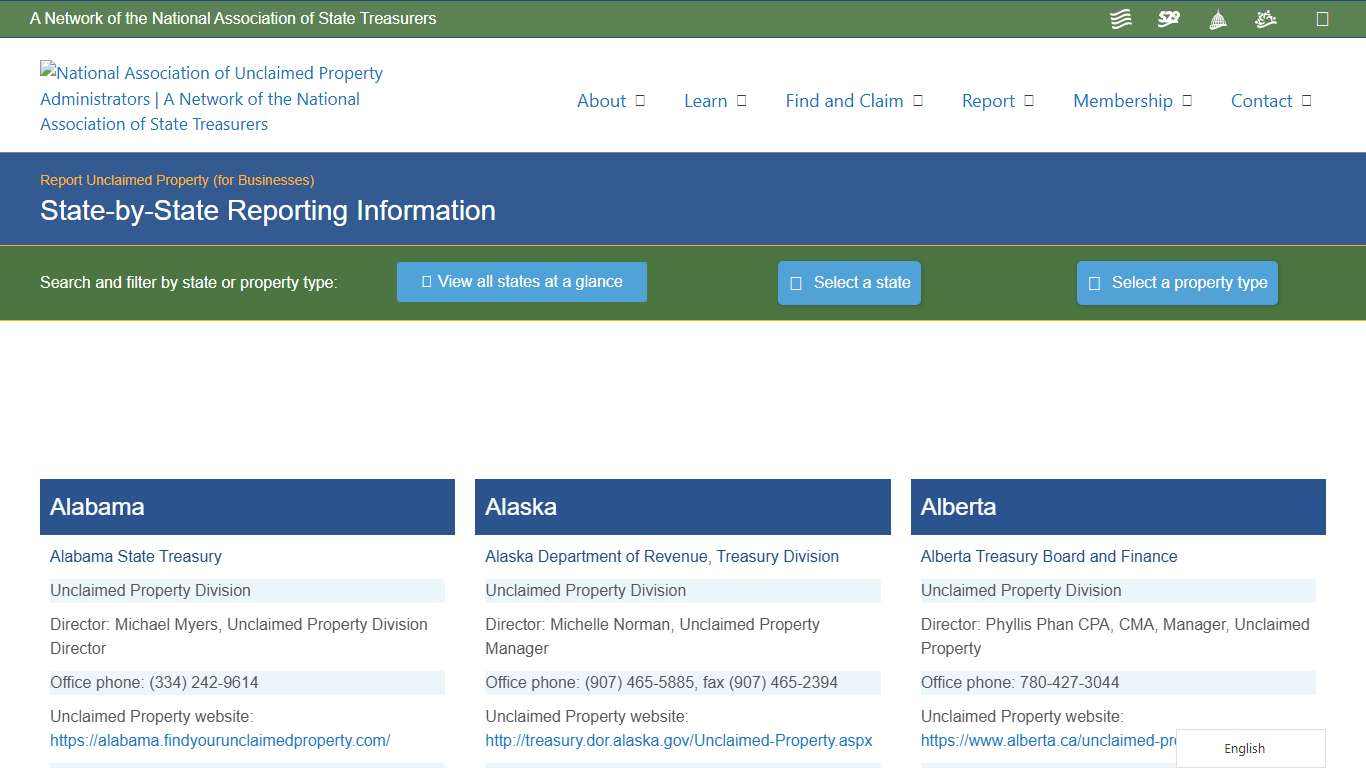

State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

Unclaimed Property website: https://treasury.ms.gov/for-citizens/unclaimed-property/ ... · National Association of Unclaimed Property ...

https://unclaimed.org/state-reporting/

GENERAL FREQUENTLY ASKED QUESTIONS Mississippi Department of Revenue

The following is intended to provide general information concerning a frequently asked question about taxes administered by the Mississippi Department of Revenue (DOR). The Mississippi Department of Revenue is responsible for the administration of the state’s revenue tax laws. The Department administers over fifty (50) different taxes and collects in excess of $10 billion annually for the support of state and local government services.

https://www.dor.ms.gov/forms-resources/general-frequently-asked-questions

In the time it takes you to change a light bulb ...

With the 2026 State Legislature in session, my team and I went to the Mississippi State Capitol today to bring awareness to the work we do at the State Treasury ...

https://www.facebook.com/story.php?story_fbid=1011118704171765&id=100058209336412The State Treasury will now be requiring a Citizenship Declaration to file an unclaimed money return. Treasurer David McRae is the first in the nation to prioritize American claims over foreign claims. SuperTalk Mississippi Facebook

The State Treasury will now be requiring a Citizenship Declaration to file an unclaimed money return. Treasurer David McRae is the first in the nation to prioritize American claims over foreign claims.

https://www.facebook.com/supertalk/posts/the-state-treasury-will-now-be-requiring-a-citizenship-declaration-to-file-an-un/1307320648067029/

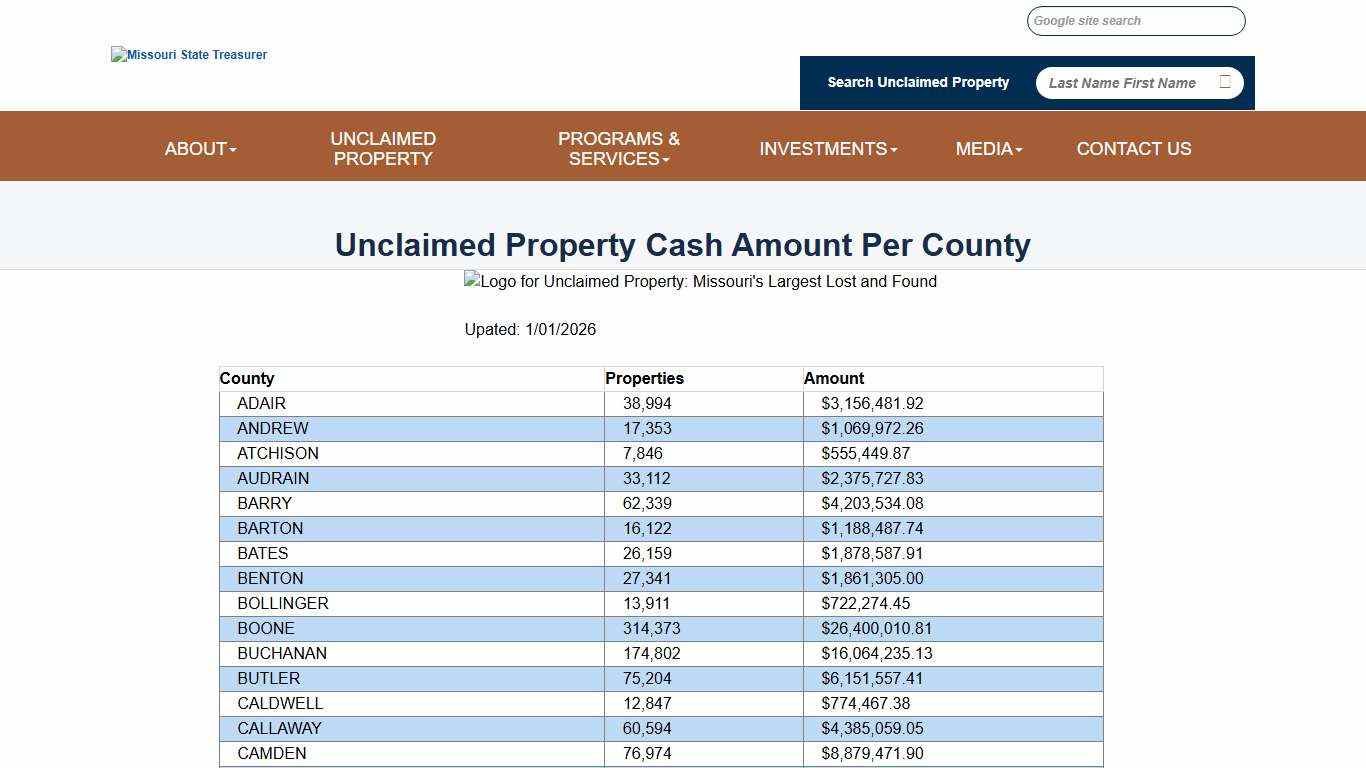

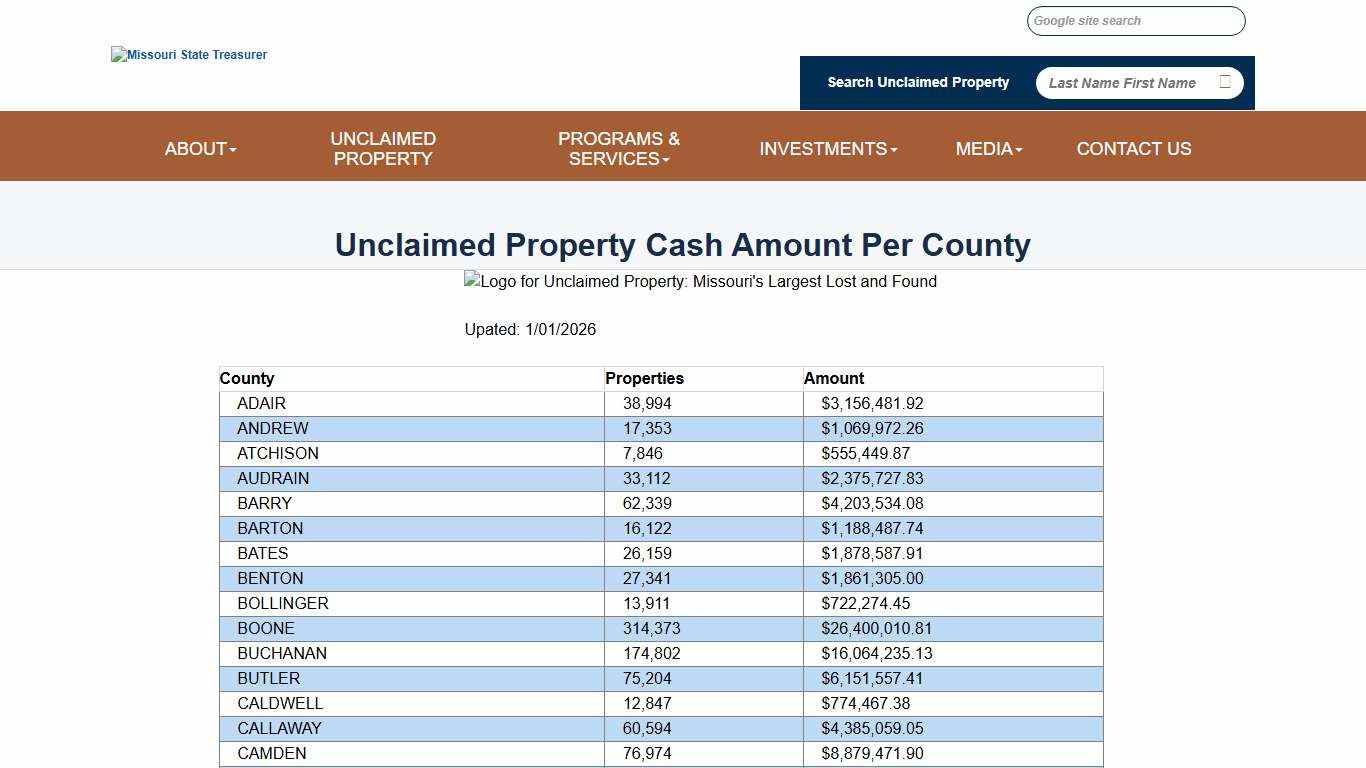

Missouri State Treasurer

Unclaimed Property Cash Amount Per County...

https://treasurer.mo.gov/UCP/PropertyCountsByCountySummary.aspx

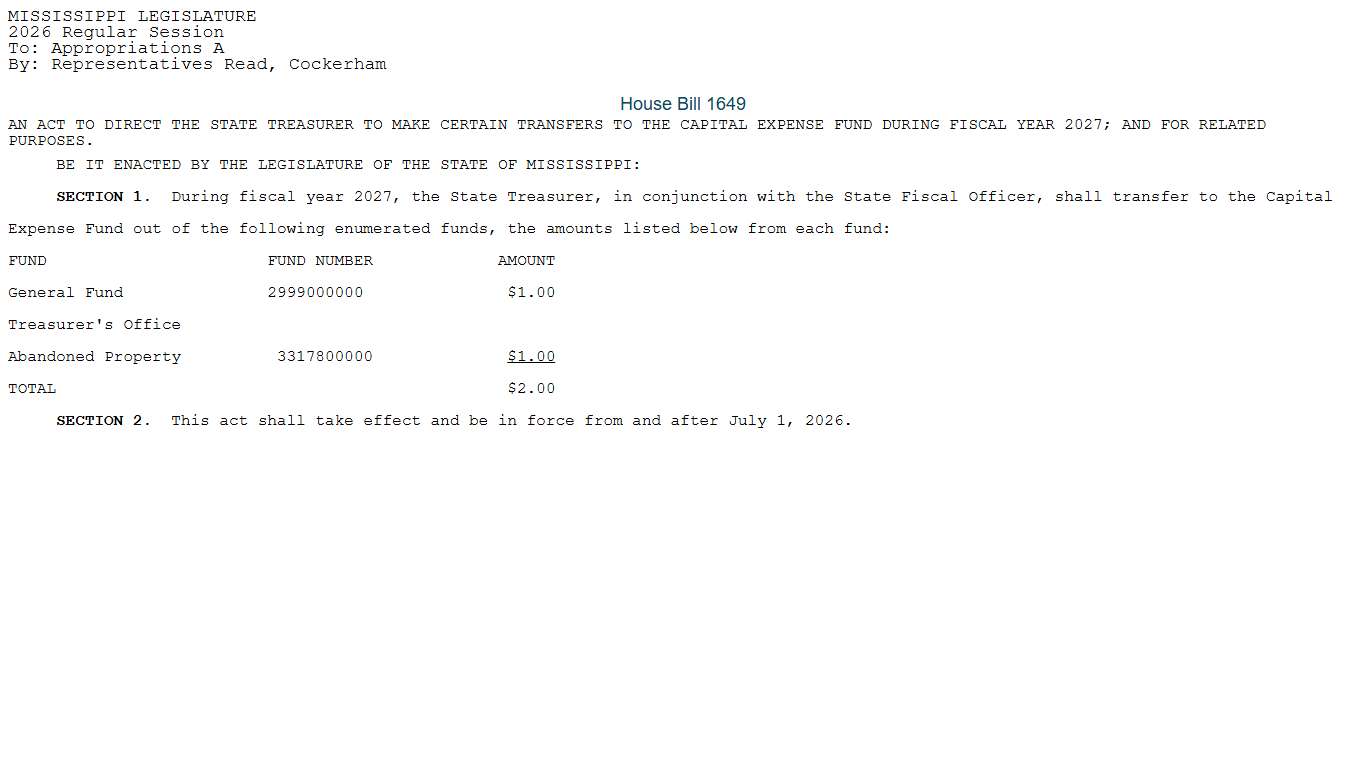

HB1649 (As Introduced) - 2026 Regular Session

MISSISSIPPI LEGISLATURE 2026 Regular Session To: Appropriations A By: Representatives Read, Cockerham AN ACT TO DIRECT THE STATE TREASURER TO MAKE CERTAIN TRANSFERS TO THE CAPITAL EXPENSE FUND DURING FISCAL YEAR 2027; AND FOR RELATED PURPOSES. BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MISSISSIPPI: SECTION 1.

https://billstatus.ls.state.ms.us/documents/2026/html/HB/1600-1699/HB1649IN.htm

Search for your unclaimed property (it’s free) – National Association of Unclaimed Property Administrators (NAUPA)

Ready to find yours? Access your state's program here! There are several ways to find out if you have missing money, including visiting one of your state’s official unclaimed property outreach events. You can also find out immediately by using one of two key online search resources.

https://unclaimed.org/search/

McRae Announces $2 Million Now Returned to Rightful Owners of Unclaimed Property – WLZA Lazer 96.1

Mississippi State Treasurer David McRae today announced $2 million has been returned to the rightful owners of the unclaimed property since he took office in January. In total, the Office of the Treasury has processed and closed 1,083 unclaimed property claims.

https://lazer961.com/mississippi-news/mcrae-announces-2-million-now-returned-to-rightful-owners-of-unclaimed-property/

Missouri State Treasurer

Unclaimed Property Cash Amount Per County...

https://treasurer.mo.gov/UCP/PropertyCountsByCountySummary.aspx

Unclaimed Property Division Mass.gov

The Unclaimed Property division of the Massachusetts state Treasury connects citizens with their abandoned property such as bank accounts, uncashed checks, stocks or dividends, insurance policies, or the contents of safe deposit boxes. The state holds this reported property until the rightful owner or heir claims it.

https://www.mass.gov/orgs/unclaimed-property-division

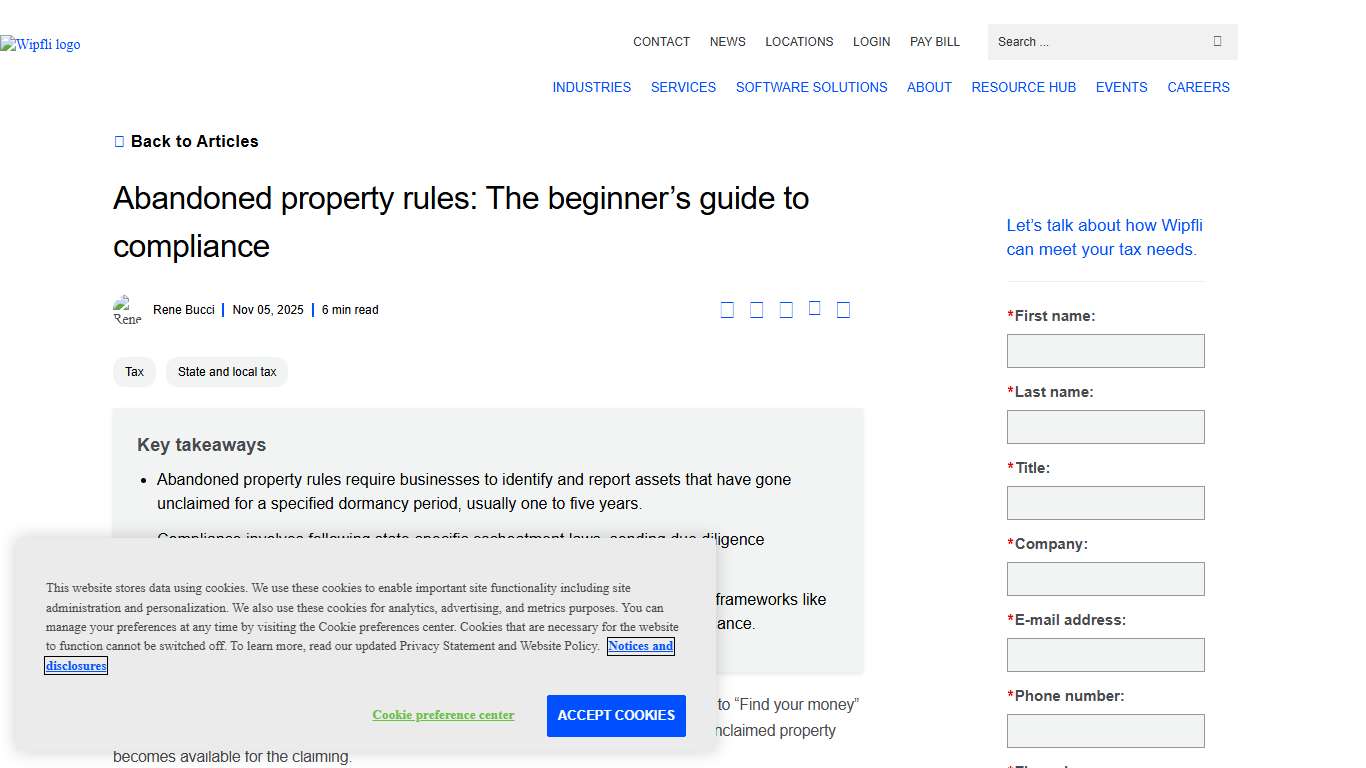

Abandoned property rules: The beginner’s guide to compliance Wipfli

Abandoned property rules: The beginner’s guide to compliance - Abandoned property rules require businesses to identify and report assets that have gone unclaimed for a specified dormancy period, usually one to five years. - Compliance involves following state-specific escheatment laws, sending due diligence notifications to owners, and meeting varying reporting deadlines.

https://www.wipfli.com/insights/articles/tax-understand-the-rules-related-to-unclaimed-property-in-your-state